An influential economist thinks high inflation could last for decades.

Former U.K. central banker Charles Goodhart reasons that inexpensive labor had kept prices and wages down since the 1990s and will end because of persistent era of worker shortages. Reasons include lower birth rates and loss of cheap labor in China and Eastern Europe.

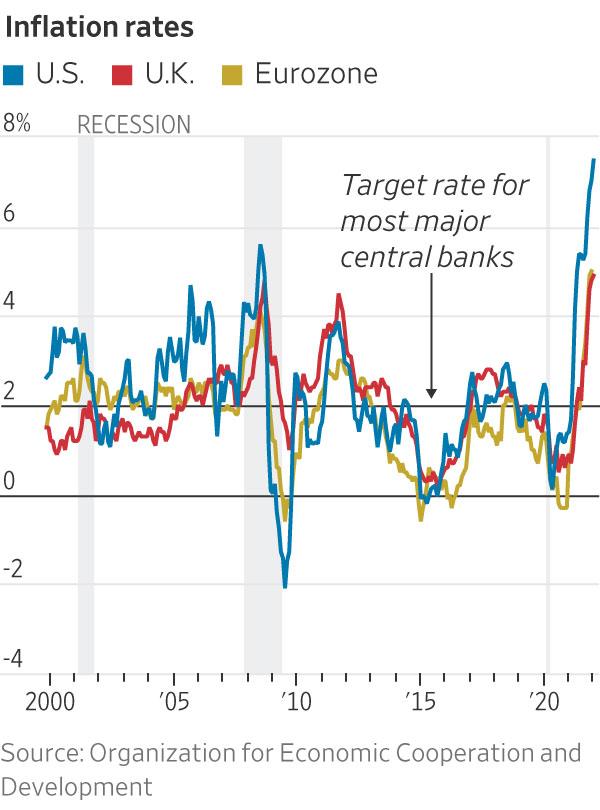

He predicts inflation in advanced economies will settle at about 3 percent to 4 percent around the end of 2022 and stay that level for decades.

His thoughts are widely read, reports The Wall Street Journal, and have caught the attention of central bankers in U.S., Europe and China.

AdvertisementQ: Could inflation stay high for decades?

Gary London, London Moeder Advisors

NO: Inflation comes from excess demand. The pandemic, now exasperated by the Russian invasion of Ukraine, are the culprits. This is short term. Demand pressures and spending will eventually come down. The argument that the world is aging ignores the fact that older persons spend less. Also, the notion that worker shortages are permanent (e.g., scarcity of labor causes labor price increases) is likely to be neutered by the substitution of technology in place of people.

Alan Gin, University of San Diego

YES: The U.S. is likely to have a labor shortage for the foreseeable future. More than 3 million people have left the labor market due to early retirement or COVID-19 (deaths and disability). Combined with the increasing retirement of the baby boom generation and slow population growth, the labor market will remain tight and wages will keep rising. The same applies to the rest of the industrialized world. This could be offset somewhat by increasing population growth in Africa and technology leading to more automation.

Bob Rauch, R.A. Rauch & Associates

YES: The Fed’s inability to see that this burst of inflation would be more persistent has hurt its credibility. Fed officials will have to move cautiously and not overreact to inflation that is significantly higher than reported but will likely level off at 3 percent. The combination of the pandemic and war has distorted the economy, ergo, Fed officials must tame inflation and prevent a recession concurrently. It’s about time they changed their monetary playbook.

James Hamilton, UC San Diego

NO:Inflation is ultimately determined by the government’s monetary and fiscal policy, not by demographics or corporate greed. And inflation is intensely disliked by Americans of all walks of life. Inflation led the voters to throw Jimmy Carter out of office, and Joe Biden may suffer the same fate. If whoever succeeds Biden doesn’t bring inflation down, they’ll soon be out as well. It won’t take politicians decades to figure this out.

Austin Neudecker, Weave Growth

NO:Predicting inflation decades into the future requires understanding a multitude of complicated factors. Experts who cite the global shortage of labor increasing wages could underestimate the accelerating efficiency gains from automation. Prices of vital commodities (e.g. oil) may oscillate wildly as we improve our energy production — meanwhile requiring substantially more power. Central banks’ attempts to curb inflation by raising interest rates may backfire and cause a recession and unemployment.

Chris Van Gorder, Scripps Health

NO: If there is a sustained increase in labor costs, businesses will make investments to improve productivity, lessening their dependence on expensive labor and helping control inflation. That was the case with the auto industry. In addition, we can take other steps to keep inflation more in check, such as cutting the high taxes on gasoline in California. But this prediction is also somewhat dependent on worldwide economics impacted by decisions being made in Europe and China.

Norm Miller, University of San Diego

YES:High is relative, but 3 percent to 4 percent is certainly possible for a while. We were in a more global substitutable labor market until recently, and COVID-19 shook our supply chains, and Russia will spike our gas prices, but the lingering factor is that we increased the money supply in 2019, especially 2020 and in 2021 more than ever in our history. Inflation responds a year to two years after such money supply surges and that is where we are right now.

Jamie Moraga, IntelliSolutions

NO:There are several factors that are influencing increased inflation including high government spending, supply chain disruptions, worker shortages, a pandemic, and significant geopolitical issues. While inflation is no longer “transitory” and it may not decrease back to the 2 percent inflation target level for a while, it isn’t likely to stay high for decades. We will have to address the issue of our shrinking working age population and declining fertility rates. These demographics could have long-term impacts on the global economy, including future inflation rates.

David Ely, San Diego State University

NO:In the coming decades, economies will surely experience periods of inflation above their central bank’s targets. And, it should be acknowledged that shifting demographics will put persistent upward pressure on wages and prices. However, other factors should work to keep inflation in check. Technological advances and productivity gains will allow more to be produced with fewer workers. Central banks can be expected to use their policy tools to manage inflation as well.

Ray Major, SANDAG

YES:Historically, interest rates have hovered around 3 percent to 5 percent, so it is not unrealistic that rates in the 3 percent to 4 percent range could persist for decades unless efforts are made to control them. Inflation has averaged around half of historical interest rates in the past two decades because of abundant, low-cost labor from the far East. Labor shortages in developed countries and rising wages in developing countries will keep upward pressure on prices in the future.

Lynn Reaser, Point Loma Nazarene University

NO:While inflation will still be over 4 percent this year, it should gradually recede. Aggressive monetary policy is now planned, which will blunt some of the strength in overall spending. Supply chains should begin to normalize as COVID disruptions ease. Alternative producers and ultimate resolution of the Russia-Ukraine conflict should bring moderation to oil and food prices. Large interest rate hikes risk a recession, but monetary policymakers are committed to curbing inflation.

Kelly Cunningham, San Diego Institute for Economic Research

YES:If 3 to 4 percent inflation is considered high, inflation will be at least that much for a long time. The considerable expansion of the money supply over the past 14 years, including unprecedented escalation in 2020, has lasting effects on U.S. inflation that will take considerable time to be fully absorbed. Prolonged hyperinflation could demolish the American financial system. Interest rates must rise and the Fed should discontinue quantitative easing to end fabricating dollars.

Phil Blair, Manpower

YES: If high is defined as three percent or more. It feels like our world economy is driven by just-in-time thinking now. Any slight burp in the path from raw material to the finished product in consumer’s hands causes a shortage. And this shortage immediately ramps up costs, be it oil, shipping, and, unfortunately, now war. We will never know or be able to anticipate just what product (toilet paper) or service (shipping) will be effected when, for how long or why.

Reginald Jones, Jacobs Center for Neighborhood Innovation

Not participating this week.

Have an idea for an EconoMeter question? Email me atphillip.molnar@sduniontribune.com. Follow me on Twitter: @PhillipMolnar