New York —European caustic soda contract prices for the second quarter are being discussed at an increase, market sources say, as the coronavirus' impact on chlorine derivatives demand has squeezed the supply of caustic soda, a by-product of chlorine production.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.

Register Now

This marks a reversal from earlier talk of a price cut because of the bearish fundamentals for caustic soda, which have been in place since 2019.

This week, however, European producers were heard announcing Eur30-Eur40/mt ($32-$43/mt) increases above Q1 contract prices, with expectations of even larger increases as supply remains under pressure as the deepening impact of the coronavirus pandemic weighs on chlorine demand.

"There is lots of nervousness in the market about availability. Price is a secondary priority," a source said. "Chlorine production is severely impacted by [the coronavirus] issues, and hence caustic will get tight," he added.

Seasonal maintenance stops at Northwest European chlor-alkali plants since early March were also seen as an important factor in limited supply and lower stocks of caustic soda. This was followed by a number of automotive factory closures in Europe as a result of the coronavirus pandemic, which significantly reduced demand in the isocyanates segment (TDI, MDI), a chlorine derivative used in the production of polyurethanes, used for car seats and inside panels. Pressure is also mounting from the automotive closures on polyvinyl chloride, the most important downstream market for chlorine. PVC has also begun to be affected by the slowdown in construction in the past few days, according to market sources.

"All signals point in the direction of low chlorine and current caustic stocks are low due to the maintenance stops," a source said.

On the other hand, caustic soda demand has remained stable, with pockets of higher-than-average demand, partially linked to the greater use in the production of toilet and tissue paper and soaps, sources said. The demand outlook was mixed, however, in the major caustic soda consumer segment, such as alumina, which was heard experiencing a degree of demand loss from the car maker closures, as well as dampened consumer demand. "The European caustic soda market is getting tighter due to maintenance, moreover we have many concerns on chlorine demand," a source said. "However, consumer industries like pulp and paper and aluminium are affected as well, and could start slowing down fast -- so we may face lots of volatility on the market," he added.

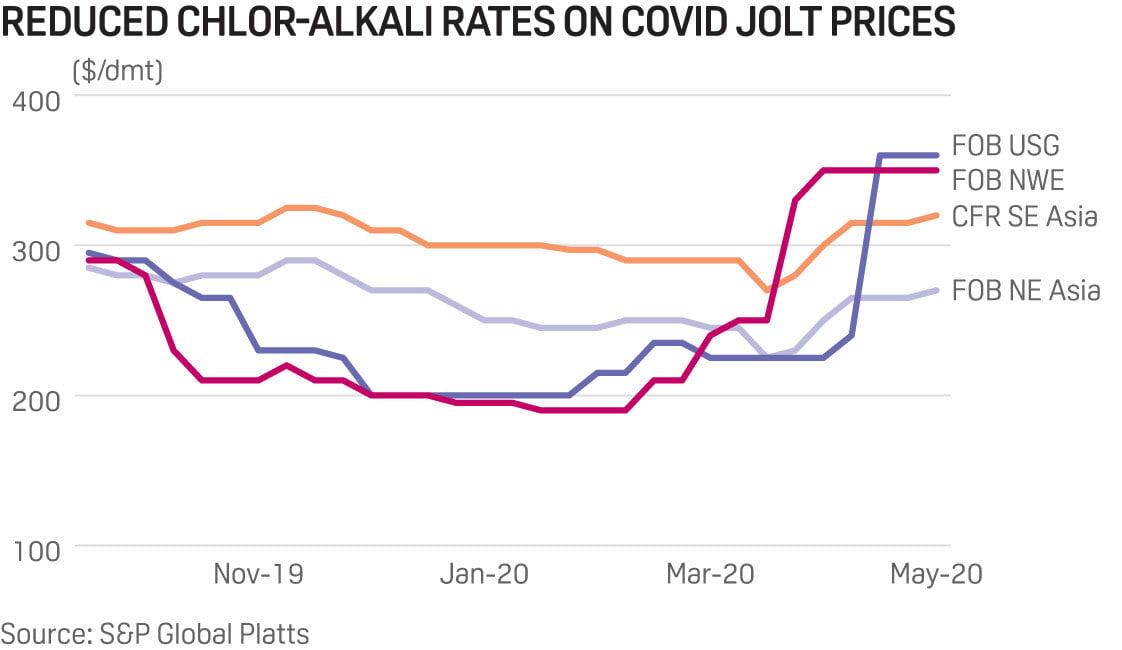

European caustic soda spot prices were last assessed Tuesday at $250/mt FOB Rotterdam, up $10 week on week, and up $60 from February's prices, S&P Global Platts data showed.