Thesis

Oil prices have risen massively in recent months, on the back of a structural supply deficit and due to the impact of the current Russia-Ukraine war. Naturally, oil companies and those related to the industry have risen. Enbridge Inc. (NYSE:ENB) and Exxon Mobil Corporation (NYSE:XOM) are two leading energy-related names. In this article, we'll pit the more defensive pipeline player against Exxon Mobil, which has more torque to higher oil prices. Both seem like solid investments at current prices, but depending on your goals you might prefer one over the other.

How Are Exxon Mobil And Enbridge Different?

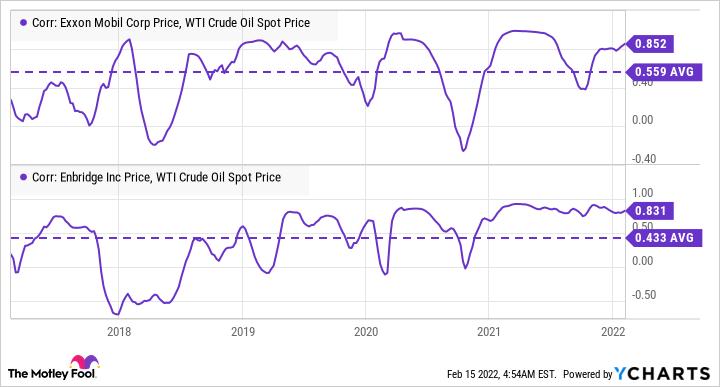

Both companies are active in the vast oil and natural gas space, but their business models differ quite a bit. Exxon Mobil searches for, produces, processes, and sells oil, natural gas, and derived products, such as gasoline and chemicals. It thus is highly exposed to supply/demand shifts and price changes in these commodities.

On the other side, Enbridge is an infrastructure player that facilitates the transportation and storage of oil, natural gas, and related products. It mostly has fee-based contracts in place, getting paid a more or less fixed sum for transporting a specific volume of these commodities through its pipes. It thus has low exposure to pricing trends when it comes to these commodities, making it a much more defensive, less volatile business compared to Exxon Mobil. Enbridge has a growing renewable energy business as well, owning wind parks in Europe's North Sea, for example.

XOM And ENB Key Metrics

Both companies are widely held by income investors, and rightfully so. Enbridge Inc. offers a dividend yield of 6.1% right now and has raised its dividend for 27 years in a row. Exxon Mobil has a lower dividend yield, at 4.6%, but its dividend growth track record is even longer than that of Enbridge, as XOM has raised its dividend for a massive 39 years in a row. Both companies are Dividend Aristocrats and I believe that there is a high likelihood that investors will continue to benefit from steadily rising payouts. Dividend growth has been faster at Enbridge, which has a 5-year growth rate of around 10%, whereas XOM's 5-year dividend growth rate is 3%. That could change going forward, however. As XOM has more exposure to higher oil prices, it could be able to ramp up its dividend growth considerably in the coming years.

During the pandemic, the performance for the two stocks was rather different. Exxon Mobil saw its earnings drop below zero in 2020's Q2 and Q3 on the back of a huge global decline in consumption that made oil prices plummet. Enbridge's more defensive business model allowed the company to remain highly profitable even during those times. In fact, ENB saw its cash flow per share rise during 2020, compared to 2019, proving its excellent resilience.

On the other hand, XOM's massively larger exposure to commodity prices is a tailwind in the current environment. While Enbridge is forecasted to experience cash flow per share growth of around 7% this year, on the back of some rate increases and new projects coming online, XOM's growth will be on a completely different level. While Exxon Mobil earned $5.38 last year, current forecasts for 2022 see the company growing its earnings per share by 50%, to more than $8 this year. Due to the fact that oil prices jumped up very recently (caused by the Russia-Ukraine war), analyst estimates could see further upward revisions, and actual results may very well come in way above $8 this year.

Are XOM And ENB Good Long-Term Investments?

Renewable energy is experiencing growth all around the world, but that doesn't mean that the world won't need oil and natural gas in the future. Instead, global energy demand is growing so quickly that consumption of oil and natural gas will likely rise in the coming years, despite the buildout of renewable energy infrastructure.

The IEA forecasts that natural gas demand will grow by 30% through 2040, meaning that there is a growth runway of at least two decades. Following that, there will likely be a plateau phase, but even that will be at way higher demand levels compared to today. Likewise, the IEA forecasts that global oil demand will continue to grow through 2030, before entering a long plateau phase (at levels higher than today).

Overall, this gives the energy industry a pretty solid outlook over the coming years and even decades. Production will naturally not grow at a massive rate for most producers, but that's not needed anyway. Between efficiency gains, buybacks, and dividends, even stable production volumes could allow for compelling total returns as long as the pricing environment is supportive. Due to underinvestment in new production -- a trend that has been in place since 2014's oil price crash -- it looks like oil prices will be quite appealing for producers in the foreseeable future.

With high oil and natural gas demand requiring high levels of production, the outlook for Enbridge and other midstream companies is good as well. After all, the oil and natural gas that is produced need to be moved to the point where it is being consumed or processed. This means that the long-term business outlook for Enbridge is positive as well. Increasing regulation also means that building new pipelines has become more complicated and more expensive compared to the past. Especially pipelines that cross state lines have become almost impossible to build. This means that existing infrastructure is very hard or almost impossible to replace -- making Enbridge's pipes in the ground more valuable.

Of course, solid business prospects alone do not make ENB and XOM good long-term investments. Valuations should be reasonable as well, but that seems to be the case still:

XOM trades at 5x this year's EBITDA, and at 7x cash flows. This pencils out to a 14% cash flow yield (before capital expenditures), which is quite attractive. Even after paying for new projects, Exxon Mobil should have large amounts of surplus cash flows that can be returned to the company's owners through a combination of buybacks and dividends.

Enbridge is more expensive in absolute terms, but that is not a reason for concern. First, its resilient business model (cash flows kept growing even during the pandemic) warrants somewhat of a premium valuation. On top of that, Enbridge does not need to invest a lot of money in its business, as its pipelines generally require low maintenance spending only. This means that a larger portion of its cash flows can be turned into free cash flows, which partially balances out the higher operating cash flow multiple compared to Exxon Mobil. The dividend yields of these two companies also indicate that they aren't expensive today.

Is It A Good Time To Invest In Either Exxon Mobil Or Enbridge?

Buying into these or other energy names one or two years ago would have been an even better idea. Over that time frame, they enjoyed compelling total returns. But that doesn't mean that total returns from the current prices can't be solid as well.

As we have seen above, neither stock is especially expensive. Both companies offer compelling dividend yields, especially Enbridge with its 6%+ yield. XOM's dividend yield is somewhat lower, but the company will most likely return more cash to its owners via buybacks this year.

As a portion of all equities, energy and energy-related names are still at a below-average level. Energy names had underperformed broad markets (driven by tech) for years. There is no guarantee that this will reverse, but there definitely is a chance for this trend to continue to reverse. Exxon Mobil, for example, is currently trading below levels seen in 2017-2019, despite the fact that it will likely be massively more profitable this year.

As long as the pricing environment for energy names remains constructive, both Exxon Mobil and Enbridge could thus easily continue to outperform the broad market.

Is XOM Or ENB Stock The Better Buy?

Exxon Mobil will generate enormous cash flows with oil trading at $100+. There is no guarantee that oil will remain this high for years, however. Right now, demand continues to recover and supply remains constricted due to underinvestment and the current Russia-Ukraine conflict. But should this change, oil prices could decline, which would lead to lower profitability for Exxon Mobil. XOM thus is the pick for someone that wants significant oil price exposure. Their low-cost assets in the Permian Basin and Guayana will be quite profitable with oil at $70 or $80, but shares might still decline if oil declines from current levels. On the other hand, XOM would most likely outperform if oil prices continue to climb or remain elevated.

Enbridge has less exposure to oil prices -- both to the upside and the downside. Instead, it's a reliable cash flow machine that offers a strong and growing dividend. For someone looking for a defensive play that will do well in all oil price scenarios, Enbridge is thus the better pick.

Ultimately, going with midstream companies and oil producers for a mix of defensive income and some oil price exposure could be a good idea for investors, but some might decide to go for only one of the two.